Bank Nifty and Nifty Prediction for Tomorrow, 14 March 2024

Indian value benchmarks tumbled on Wednesday. The homegrown business sectors began the day on a hopeful note, following positive worldwide signals. The Sensex and Nifty quickly turned negative and expanded their misfortunes as the meeting advanced. Among the areas, excepting FMCG any remaining sectoral files shut in the red with Metal, Media, Energy, and Realty falling over 5% today.

The market broadness was agreeable to venders. On the NSE, 192 offers progressed while 2424 offers declined today. The NSE’s unpredictability list “India VIX” climbed 5.82% to 14.43.

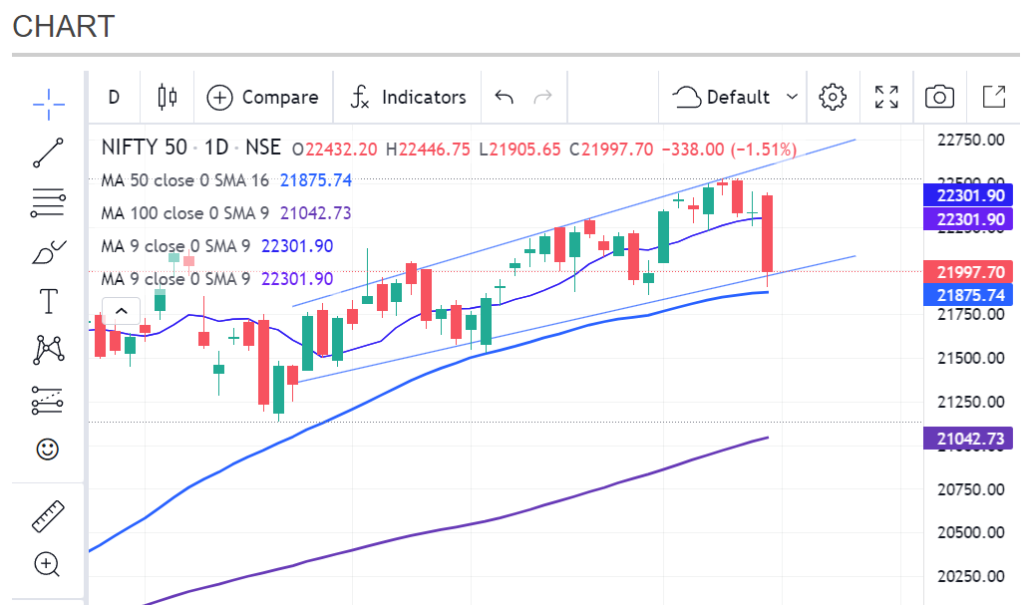

The more extensive business sectors fell forcefully and failed to meet expectations, contrasted with their bigger companions, as the Nifty mid and smallcap file declined 4.40% and 5.28% individually. Eventually, Sensex was down 906.07 focuses or 1.23% and shut down at 72761.89, while Nifty declined 797.05 places or 5.28% and settled at 21997.70.

Nifty and Bank Nifty Futures Price Movement

The Nifty prospects cost for the Walk series opened at 22505 making a positive opening of 57.95 focuses on Wednesday. It has contacted an intraday high of 22515 and a day’s low of 22025

The Nifty fates cost has given an intraday development of 490 places. At last, the Nifty fates shut lower by 370.60 focuses or 1.65 percent at 22076.45 levels.

The Bank Nifty prospects for the Walk series opened at 47600. It made a positive opening of 72.75 focuses on Wednesday. The Bank Nifty fates contacted an intraday high at 47684.30 and a day’s low at 46947.55

During the day, the Bank Nifty prospects have given a development of 736.75 places. Eventually, Bank Nifty Prospects shut lower by 505.25 focuses or 1.06 percent and shut down at 47022 levels.

Nifty & Bank Nifty Prediction for Tomorrow, 14 March 2024

Range-Bound Pattern: All Up Moves can start benefit Booking @ 22120 while Generally Down Moves can Start Short Covering @ 21950.

Nifty prospects Walk series shut down at 22076.45 a premium of 78.75, contrasted with Clever’s end 21997.70 in the money market.

Assume the Nifty prospects move over 22132 and support. Then the Nifty file can exchange the scope of 22170-22216-22236 levels during the day.

In the event that the Nifty prospects share cost moves under 22050 and is maintained. Then, at that point, the record prospects can exchange at 22012-21980-21935 levels during the day.

Bank Nifty Futures Prediction for Tomorrow, 14 March 2024

Essential Pattern in Bank Nifty Prospects Negative

Range-Bound Pattern of Bank Nifty Future: All up moves can Start Benefit Booking @ 47200 while Generally down moves can Start Short Covering @ 47750.

Bank Nifty prospects for the Walk series shut down at 47022, along with some built-in costs of 40.7 contrasted with Bank Nifty end of 46981.30 in the money market.

Assume, the Bank Nifty prospects move over 47220 and maintain, then the file can exchange the scope of 47285-47380-47502 levels during the day.

On the off chance that the Bank Nifty fates move under 46940 and support, the file can exchange the scope of 46830-46756-46635 levels during the day.

Global Market Updates

The other Asian financial exchange files shut blended on Wednesday. Japan’s Nikkei 225 eradicated early gains and finished lower for the third consecutive meeting, as financial backers dread the probability of a strategy shift in the Bank of Japan’s one week from now meeting. Australia’s S&P ASX 200 expanded its past meeting acquires today.

South Korea’s Kospi record finished higher, as the country’s joblessness rate came lower in February than the earlier month. The Shanghai file shut lower because of the vulnerability of the strategy course from Beijing. Hang Seng pared early gains and shut level to the negative, as Chinese property designer recorded in the city hauled the files. The Waterways Times, Taiwan, and SET Composite finished in the green region.

European financial exchange files exchanges hardly higher on Wednesday, as financial backers processed the US expansion and the UK’s Gross domestic product information. The financial information delivered in the UK showed that the country’s GPD development rose in January.

In the US, the Dow Jones and Nasdaq fates are exchanging imperceptibly higher on Wednesday at 5.10 p.m. IST, demonstrating a positive opening for the US showcases today.

Conclusion

The more extensive business sectors endured a critical shot because of worry about the high valuations in mid and little cap stocks. Dealers chose to lessen their openness and this prompted a remedy in the business sectors. Furthermore, the monetary information delivered on Tuesday wasn’t promising, inciting merchants to take benefits and hold off on making long haul speculations for the present.

Tomorrow, Indian business sectors will open according to worldwide signs. You can likewise follow our Day to day Morning Report at 7:30 a.m. for market heading. You can likewise follow our Clever and Bank Clever help and opposition levels.