Bank Nifty and Nifty Prediction for Monday, 8 April 2024

Indian value benchmarks shut practically level on Friday. Sensex and Nifty finished blended in with little change after a reach bound meeting post RBI money related strategy result. As generally expected, RBI unaltered the repo rate, at 6.5% for the seventh back to back time and kept the financial arrangement position at the withdrawal of convenience.

Among the areas, Nifty Realty, Banks, and Monetary Administrations acquired the most, while selling pressure was seen in the IT, Media, and Auto Areas. The market expansiveness was solid on Friday. On the NSE, 1607 offers progressed, while 1014 offers declined. The NSE’s unpredictability record, “India VIX” acquired 1.04% to 11.34.

The more extensive business sectors beat the value benchmarks, as the Clever midcap and smallcap files shut higher by 0.56% and 0.84% separately. Eventually, Sensex shut edge higher by 20.58 focuses or 0.3% and finished at 74248.22, while Nifty finished level to the negative.

Nifty and Nifty Bank Futures Price Movement

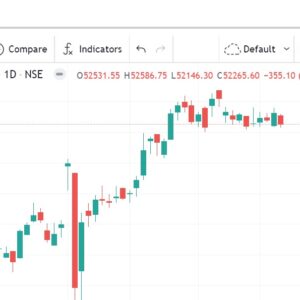

On Friday, fifth April, the Nifty fates (April Series) opened at 22570 levels. The list made a negative opening of 42.75 focuses from the past close. It contacted an intraday high of 22618 and a day’s low at 22505.10.

The file moved to 112.9 focuses on Friday, and it shut marginally lower by 1.3 focuses or 0.01 percent and finished at 22610.95 levels.

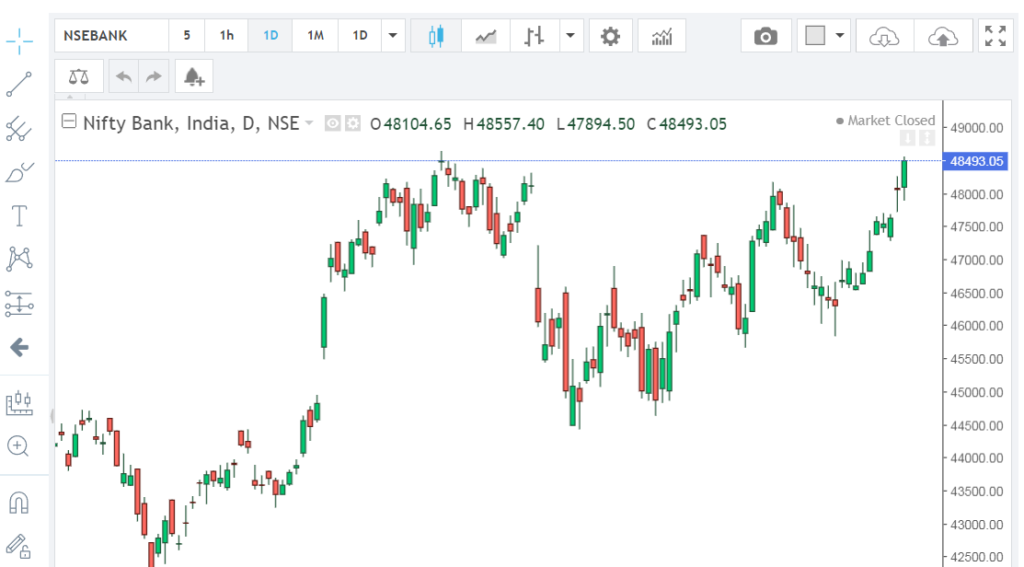

On Friday, the Bank Nifty prospects (April Series) opened at 48170 levels. The file made a negative opening of 29.1 places and contacted an intraday high at 48725 and a day’s low at 48014.05.

The Bank Nifty prospects gave a development of 710.95 places and completed higher, by 490.90 focuses or 1.02 percent and finished at 48690 levels.

Nifty & Bank Nifty Prediction for Monday, April 8, 2024

Essential Nifty Pattern in Fates: Positive

Range-Bound Pattern of Clever Fates: All up Moves can start Benefit Booking @ 22700 while Generally Down Moves can start Short Covering @ 22500

Nifty fates April series shut down at 22610.95, a premium of 91.25, contrasted with Nifty end of, 22513.70 in the money market.

Assuming the Nifty prospects share cost moves over 22630 and maintains. The Nifty file prospects can exchange 22662-22690-22727 during the day with a stop deficiency of 22609.

Assuming the Nifty prospects share cost moves under 22557 and is maintained. Then, at that point, it can exchange the scope of, 22527-22485-22454 during the day with a stop deficiency of 22580.

Bank Nifty Futures Prediction for Monday, April 8, 2024

Essential Pattern of Bank Nifty Fates: Positive

Range-Bound Pattern of Bank Nifty Future: All up Moves can start benefit Booking @ 49000, though Down Moves can Start Short Covering @ 48500

Bank Nifty fates April series shut down at 48690, at a higher cost than normal of 196.95 contrasted with Bank Nifty end of 48493.05 in the money market.

Assume the Bank Nifty fates move over 48760 and support, then it can exchange a scope of 48845-48970-49140 during the day with a stop deficiency of 48650.

In the event that the Bank Nifty prospects move under 48480 and maintain, the file can exchange the scope of, 48380-48250-48160 levels during the day with a stop deficiency of 48560.

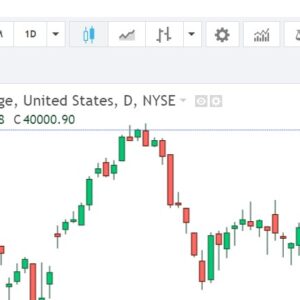

Global Stock Market Updates on Friday

The other Asian securities exchange records were shut generally lower on Friday, following negative signals from Money Road short-term. The feelings were downbeat because of hawkish remarks made by a few Took care of authorities on Thursday. Financial backers dread that the US Took care of could hold rate cuts in June. In the mean time, the rising unrefined petroleum costs because of new international strain likewise stressed financial backers, as oil costs flooded close to a six-month high.

Japan’s Nikkei 225 fell the most in the locale, down 2%, as the country’s family spending fell not exactly anticipated in February. Australia’s S&P ASX 200 shut lower by 0.56%, as the nation’s commodities dropped in February.

South Korea’s Kospi file finished 1.01% lower, turning around its past meeting’s benefit. Hang Seng continued exchanging after a vacation and shut level, while Shanghai and Taiwan financial exchanges were closed today. SET Composite and Jakarta finished higher, while Waterways Times shut lower on Friday.

European securities exchanges are exchanging pointedly lower on Friday, as financial backers processed the most recent monetary information delivered today and following negative worldwide signs. The eurozone retail deals sneaked through February, while the development list fell in Spring because of unfortunate interest. The UK’s home cost fell 1% in Spring following five months of sequential additions. The Dow and Nasdaq prospects are exchanging somewhat higher in the US, in front of month to month work reports.