Bank Nifty and Nifty Prediction for Monday, 4 March 2024

Indian value benchmarks finished with minor additions in an extraordinary exchanging meeting on Saturday. The homegrown business sectors opened higher following positive worldwide signs areas of strength for and financial information and finished with respectable additions.

All sectoral lists shut in the green, with the Media, Metal, and Realty areas acquiring the most. More extensive business sectors beat the benchmarks, as Nifty mid and smallcap files acquired 0.74% and 0.69% separately in the extraordinary short meeting.

Eventually, Sensex progressed 60.80 focuses or 0.08% and shut down at 73806.15, while Nifty acquired 39.65 places or 0.18% and completed at 22378.40. Sensex and Nifty hit another record high at 73994.71 and 22419.55 levels separately on Saturday.

Nifty and Nifty Bank Futures Price Movement

On Saturday, Walk second, the Nifty fates (Walk Series) opened at 22502.45 levels. The list has made a positive opening of 41.85 focuses from the past close. It contacted an intraday high of 22547 and a day’s low at 22443.50. The file moved to 103.5 places, and it shut higher by 61.80 focuses or 0.28 percent and finished at 22505 levels.

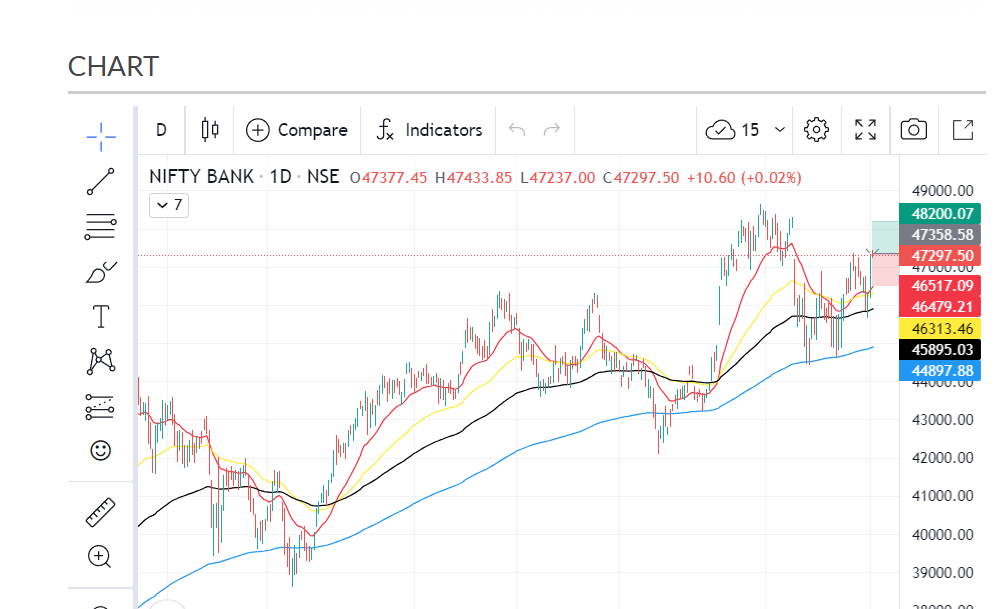

The Bank Nifty fates (Walk Series) opened at 47625 levels on Saturday. The record made a positive opening of 47 places and contacted an intraday high at 47700 and a day’s low at 47355.55. The Bank Nifty prospects gave a development of 344.45 places and completed higher by 87 or 0.18 percent and finished at 47665 levels.

Nifty Futures Prediction for Monday

Essential Nifty Pattern in Prospects: Positive

Range-Bound Pattern of Nifty Prospects: All up Moves can start Benefit Booking @ 22600 though Generally Down Moves can start Short Covering @ 22450.

On Saturday, Nifty prospects Walk series shut down at 22505 a premium of 126.6 when contrasted with Nifty end 22378.40 in the money market. Assuming the Nifty fates share cost moves over 22530 and supports. The Nifty file prospects can exchange the scope of 22564-22590-22624 during the day with a stop deficiency of 22505.

Assuming that the Nifty fates share cost moves under 22470 and is supported. Then it can exchange the scope of 22427-22390-22352 during the day with a stop deficiency of 22498.

Bank Nifty Futures Prediction for Monday, 4 March 2024

Essential Pattern of Bank Nifty Fates: Positive

Range-Bound Pattern of Bank Nifty Future: All up Moves can start benefit Booking @ 47900, though Down Moves can Start Short Covering @ 47350.

Bank Nifty fates Walk series shut down at 47665, along with some hidden costs of 367.5 contrasted with Bank Nifty end of 47297.50 in the money market. Assume the Bank Nifty prospects move over 47760 and maintain, then it can exchange a scope of 47880-47970-48140 during the day with a stop deficiency of 47670.

In the event that the Bank Nifty fates move under 47450 and maintain, the record can exchange the scope of 47330-47220-47130 levels during the day with a stop deficiency of 47535.

Global Stock Market Updates on Friday

The US securities exchange files shut higher on Friday, as the Depository yields facilitated and the Nvidia-drove rally energized other tech stocks. On Friday, the financial information showed buyer opinions suddenly declined in Feb. In the mean time, the ISM fabricating PMI declined further in February contrasted with the earlier month and stayed in compression. The downtrend monetary information pushed the Depository yields lower and supported the rate cut trusts in summer.

European securities exchanges shut higher on Friday as financial backers evaluated streak appraisals of eurozone expansion information for February. As per Eurostat, the factual office of the European Association, the title purchaser cost record tumbled to 2.6% from January’s 2.8% yet stays higher than the financial specialists surveyed by Reuters of 2.5%. The center expansion proceeded with its descending pattern, tumbling to its least level in almost two years.