Bank Nifty and Nifty Prediction for Monday, 19 February 2024

Indian value benchmarks finished with humble increases on Friday, ascending for the fourth successive meeting. The homegrown value markets opened higher following the positive worldwide prompts and exchanged on a firm note all through the meeting on the rear of weighty purchasing in forefront stocks including L&T, Infosys, and M&M.

Among the sectoral files, the Clever Auto, Pharma, and Realty areas acquired the most, while the PSU Bank and Energy areas saw some selling pressure. The market broadness was positive with the development decline showing a 2:1 proportion at the nearby.

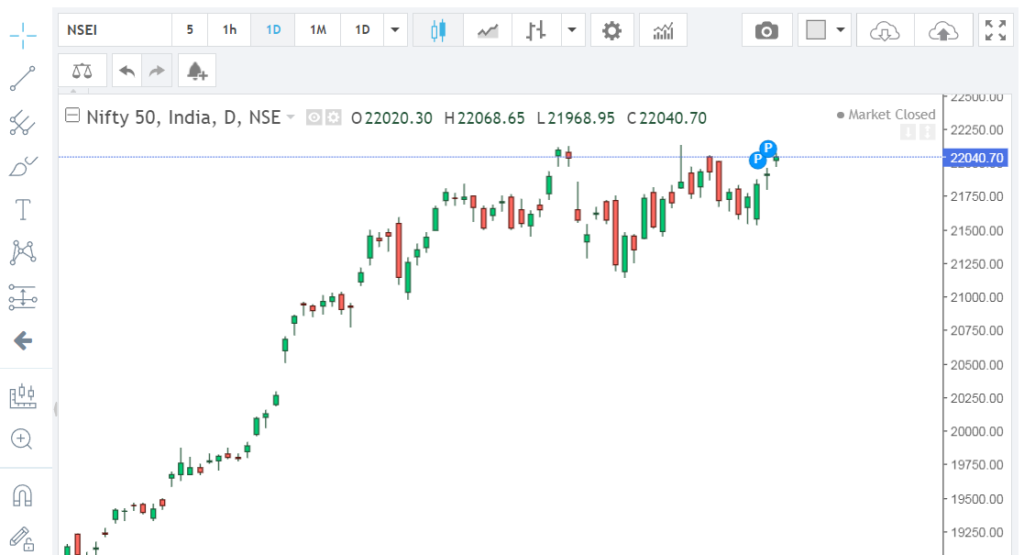

The more extensive business sectors shut higher in accordance with the bleeding edge file, as Nifty mid and smallcap records finished higher by 0.64% and 0.55% separately. Eventually, Sensex shut higher by 376.25 focuses or 0.52% and settled at 72426.64, while Nifty high level 129.95 places or 0.59% and completed at 22040.70 level.

Nifty and Nifty Bank Futures Price Movement on Friday, 16 February

On Friday, February 16, the Nifty prospects (Feb Series) opened at 22060.20 levels. The file made a positive opening, up by 55.15 focuses from the past close. It contacted an intraday high at 22139.95 and a day’s low at 22039.45

The file moved to 100.5 focuses on Friday, and it shut higher by 84.45 focuses or 0.38 percent and finished at 22089.50 levels.

The Bank Nifty prospects (Feb Series) opened at 46580 levels on Friday. The file made a positive opening of 194.95 places and contacted an intraday high at 46885.95 and a day’s low at 46350.

On Friday, the Bank Nifty prospects gave a development of 535.95 places and completed higher by 85.95 focuses or 0.19 percent and finished at 46475 levels.

Nifty & Bank Nifty Prediction for Monday, 19 Feb 2024

Essential Nifty Pattern in Prospects: Positive

Range-Bound Pattern of Nifty Prospects: All up Moves can start Benefit Booking @ 22200 though Generally Down Moves can start Short Covering @ 22050

In the event that the Nifty fates share cost moves over 22132 and supports. The Nifty record prospects can exchange the scope of 22182-22224-22254 during the day with a stop deficiency of 22104.

In the event that the Nifty fates share cost moves under 22040 and is supported. Then, at that point, it can exchange the scope of 22004-21970-21940 during the day with a stop deficiency of 22065.

Bank Nifty Futures Prediction for Monday, 19 Feb 2024

Essential Pattern of Bank Nifty Fates: Positive

Range-Bound Pattern of Bank Nifty Future: All up Moves can start benefit Booking @ 46950, though Down Moves can Start Short Covering @ 46200.

Assume the Bank Nifty prospects move over 46650 and maintain, then it can exchange a scope of 46740-46860-46970 during the day with a stop deficiency of 46570.

In the event that the Bank Nifty prospects move under 46350 and support, the file can exchange the scope of 46265-46130-46040 levels during the day with a stop deficiency of 46435.

Global Stock Market Updates on Friday

The US securities exchange records shut in the red on Friday and finished the week hardly lower. The market opinions were downbeat, as the maker cost file came in more sizzling than anticipated in January and pushed the Depository yields higher.

The authority information showed that the US Maker Costs File (PPI) had expanded by 0.3% at a five-month high in January, in the wake of hitting 0.1% in December. The center discount costs rose 0.5%, much over the market assumption for 0.1%. The 10-year US Depository yields hit an intraday high of 4.343% on Friday and shut down at 4.284%, it was settled at 4.227% on Thursday.

European financial exchange records shut higher on Friday and finished strong. The significant areas shut in the positive region with mining stocks driving the additions while utility stocks declined. On the financial front, the most recent information showed UK retail deals came in higher than anticipated in January and bounced back from a record fall in December.

On the profit front, shares in Metso acquired practically 11% after the Finnish mining hardware creator detailed a Q4 benefit beat gauges and gave a peppy viewpoint for its totals unit. Portion of NatWest acquired after the moneylender beat assumptions in the quarterly profit with a 20% expansion in entire year pre-charge working benefit.