Bank Nifty and Nifty Prediction for Monday, 16th April 2024

Introduction to Bank Nifty and Nifty

Bank Nifty and Nifty are two prominent stock market indices in India. Bank Nifty comprises the most liquid and large-cap banking stocks, representing the banking sector’s performance. On the other hand, Nifty, also known as the Nifty 50, is a diversified index representing the performance of the National Stock Exchange’s (NSE) top 50 companies across various sectors.

Factors Affecting Bank Nifty and Nifty

Economic Indicators

Economic indicators such as GDP growth rate, inflation, and industrial production play a significant role in influencing the movement of Bank Nifty and Nifty. Positive economic data often leads to bullish sentiments in the market, while negative data can trigger bearish trends.

Global Market Trends

Global market trends, including geopolitical events, trade agreements, and monetary policies of major central banks, have a considerable impact on Indian stock markets. Any significant developments in global markets can cause volatility in Bank Nifty and Nifty.

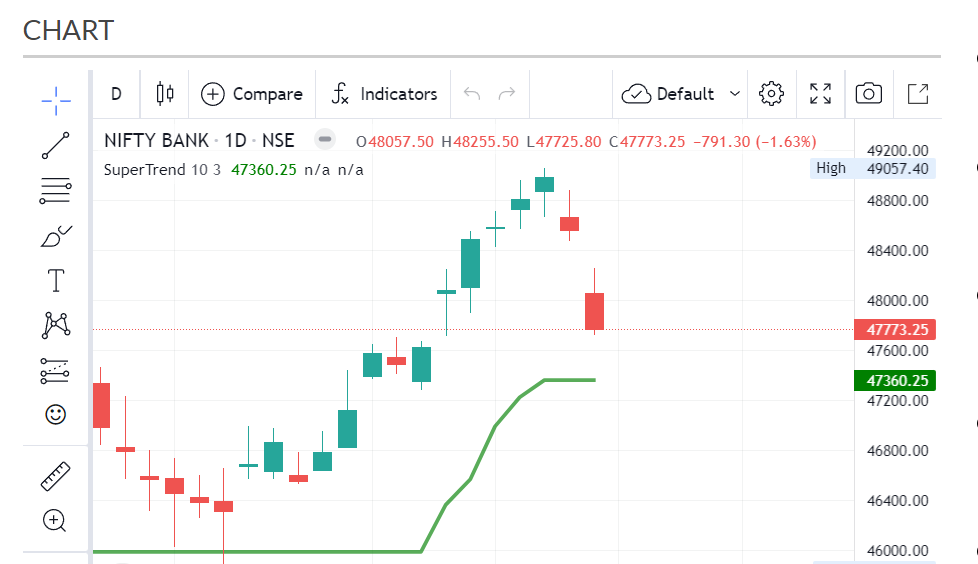

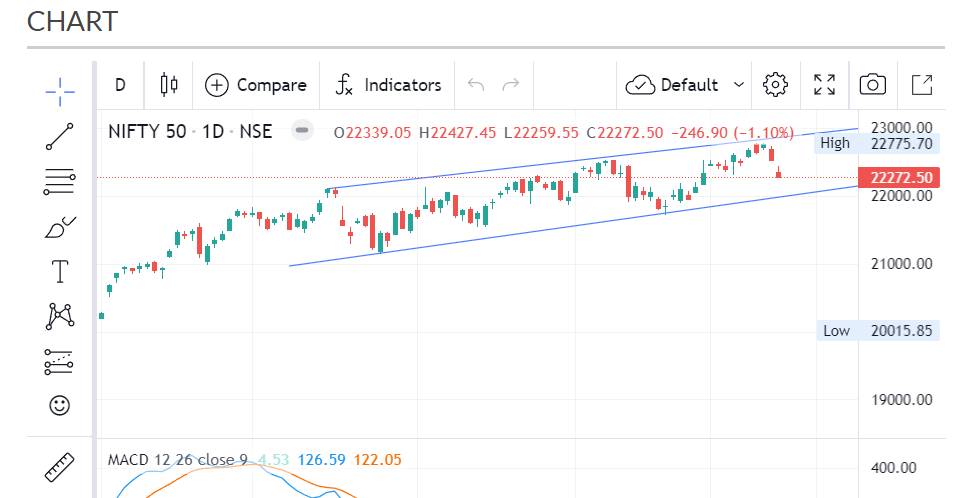

Technical Analysis of Bank Nifty and Nifty

Moving Averages

Moving averages, such as the 50-day and 200-day moving averages, are commonly used technical indicators to analyze the trends in Bank Nifty and Nifty. Crossovers and divergences between these moving averages can signal potential trend reversals or continuations.

Support and Resistance Levels

Identifying key support and resistance levels is crucial for traders to determine entry and exit points. These levels are often derived from historical price data and represent areas where the price tends to stall or reverse.

Fundamental Analysis of Bank Nifty and Nifty

Earnings Reports

Earnings reports of individual companies within Bank Nifty and Nifty constituents can significantly impact the overall index movement. Positive earnings surprises can lead to upward momentum, while disappointing earnings results may result in sell-offs.

Monetary Policies

Monetary policies announced by the Reserve Bank of India (RBI) also influence the stock market. Changes in interest rates, liquidity measures, and regulatory announcements can affect investor sentiment and market direction.

Market Sentiment and News Impact

Investor Sentiment

Investor sentiment, driven by factors such as market rumors, investor behavior, and psychological biases, can have a profound impact on short-term price movements. Positive sentiment often leads to buying pressure, while negative sentiment can trigger selling.

News Catalysts

News events, including corporate announcements, government policies, and global developments, can act as catalysts for significant price movements in Bank Nifty and Nifty. Traders closely monitor news sources for any information that could affect market sentiment.

Historical Performance

Previous Monday Trends

Analyzing historical data can provide insights into the typical behavior of Bank Nifty and Nifty on Mondays. Traders often look for recurring patterns or anomalies that may present trading opportunities.

Seasonal Patterns

Seasonal trends, such as year-end rallies or pre-budget volatility, can influence market behavior on specific days, including Mondays. Understanding seasonal patterns can help traders anticipate market movements.

Market Predictions for Monday, 16th April 2024

Analysts use a combination of technical analysis, fundamental analysis, and market sentiment indicators to make predictions for Bank Nifty and Nifty on Mondays. However, it’s essential to note that predictions are speculative and subject to market dynamics.

Trading Strategies for Bank Nifty and Nifty

Day Trading Tips

Day traders aim to capitalize on intraday price movements by entering and exiting positions within the same trading day. Popular day trading strategies include scalping, momentum trading, and range trading.

Swing Trading Strategies

Swing traders hold positions for several days or weeks to profit from short-to-medium-term price swings. Swing trading strategies involve identifying trends, using technical indicators, and managing risk through proper trade management techniques.

Risk Management

Stop-Loss Strategies

Implementing stop-loss orders is crucial for managing risk and protecting capital. Traders set predetermined stop-loss levels to limit potential losses in case the market moves against their positions.

Position Sizing

Determining the appropriate position size based on risk tolerance and account size is essential for effective risk management. Traders should avoid overleveraging and allocate capital wisely across multiple trades.

Conclusion

Bank Nifty and Nifty are integral components of the Indian stock market, reflecting the performance of key sectors and companies. Predicting their movements requires a combination of technical analysis, fundamental analysis, and market sentiment evaluation. Traders can utilize various strategies and risk management techniques to navigate the dynamic nature of the stock market.

FAQs

- How accurate are Monday predictions? Monday predictions are based on historical data, technical analysis, and market sentiment, but accuracy can vary depending on unforeseen events and market conditions.

- Can technical analysis alone predict market movements? While technical analysis provides valuable insights into price trends and patterns, it’s essential to consider fundamental factors and market sentiment for comprehensive market analysis.

- What is the significance of global events on Bank Nifty and Nifty? Global events, such as economic data releases and geopolitical developments, can impact investor sentiment and drive price movements in Bank Nifty and Nifty.

- How can beginners interpret market trends? Beginners can start by learning basic technical analysis techniques, understanding key market indicators, and staying informed about market news and events.

- Is it advisable to trade on Mondays? Trading on Mondays can be volatile due to factors such as weekend news developments and market participants’ reactions. Traders should exercise caution and implement proper risk management strategies.