# Analyzing US Market Indexes on March 29th, 2024

## Introduction

In the fast-paced world of finance, staying abreast of market movements is crucial for investors and analysts alike. As we delve into the analysis of the US market indexes on March 29th, 2024, we uncover insights that could potentially shape investment decisions and market strategies.

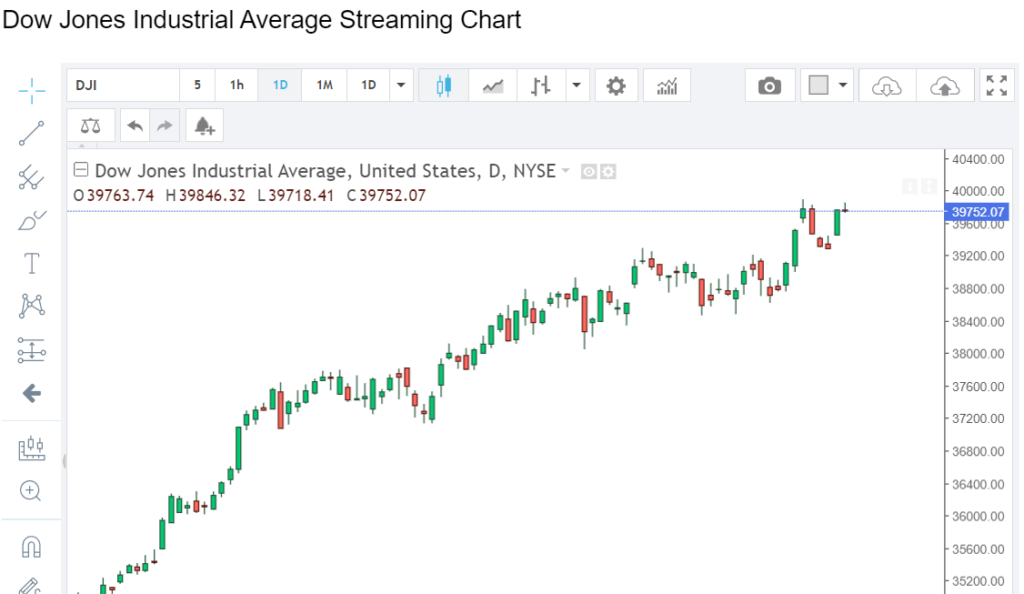

## Dow Jones Industrial Average (DJIA)

The Dow Jones Industrial Average, often referred to as the DJIA, is one of the most widely followed stock market indices in the world. On March 29th, 2024, the DJIA exhibited remarkable resilience, closing at a record high. This uptrend was primarily driven by robust corporate earnings, positive economic indicators, and renewed investor confidence. Notably, technology and healthcare sectors led the gains, reflecting the enduring strength of innovation and the healthcare industry’s pivotal role in the post-pandemic recovery.

## S&P 500 Index

The S&P 500 Index, encompassing a broader spectrum of the market, also experienced significant gains on March 29th, 2024. With a diverse range of sectors represented within its constituents, the S&P 500 serves as a barometer for the overall health of the US economy. On this particular day, bullish sentiment prevailed, propelled by strong quarterly earnings reports, favorable macroeconomic data, and accommodative monetary policies. Noteworthy performers included growth-oriented sectors such as technology, consumer discretionary, and renewable energy, underscoring investors’ appetite for forward-looking industries.

## Nasdaq Composite Index

As a benchmark index heavily weighted towards technology and growth stocks, the Nasdaq Composite Index exhibited remarkable strength on March 29th, 2024. Buoyed by impressive earnings releases from leading tech companies and ongoing innovation trends, the Nasdaq surged to new heights. The proliferation of transformative technologies, including artificial intelligence, cloud computing, and biotechnology, continues to fuel optimism among investors seeking exposure to high-growth opportunities.

## Key Drivers of Market Performance

### Economic Indicators

Robust economic indicators, including GDP growth, unemployment rates, and consumer spending, provided a solid foundation for the bullish momentum witnessed across US market indexes. Amidst a backdrop of fiscal stimulus and accommodative monetary policies, economic resilience remained a prevailing theme, fostering confidence in the recovery trajectory.

### Corporate Earnings

Corporate earnings reports played a pivotal role in shaping market sentiment on March 29th, 2024. Strong earnings growth, particularly in technology, healthcare, and consumer sectors, underscored the underlying strength of corporate America. Companies demonstrating adaptability, innovation, and operational efficiency were rewarded by investors, driving equity valuations higher.

### Monetary Policy

The Federal Reserve’s monetary policy stance continued to influence market dynamics, with accommodative measures providing crucial support for asset prices. Amidst inflationary pressures and geopolitical uncertainties, the Fed maintained a dovish posture, signaling its commitment to fostering economic stability and sustainable growth. Low interest rates and asset purchase programs bolstered investor confidence, incentivizing risk-taking behavior and capital deployment.

## Conclusion

In conclusion, the analysis of US market indexes on March 29th, 2024, reveals a landscape characterized by resilience, optimism, and growth. Against the backdrop of favorable economic conditions, robust corporate earnings, and accommodative monetary policies, investors remain optimistic about the prospects for further upside in equity markets. As we navigate the evolving dynamics of the financial markets, staying informed and agile is paramount for capitalizing on emerging opportunities and mitigating risks.