# Analyzing US Market Indexes on March 25th, 2024

## Introduction

In today’s dynamic financial landscape, staying abreast of the latest market trends and insights is paramount for investors and analysts alike. On March 25th, 2024, the US market indexes experienced notable movements, prompting a closer examination of the underlying factors driving these fluctuations.

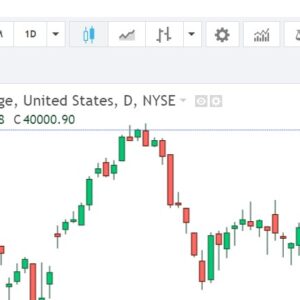

## Dow Jones Industrial Average (DJIA)

The **Dow Jones Industrial Average (DJIA)**, a barometer of the stock market’s performance, exhibited intriguing behavior on March 25th, 2024. Amidst economic data releases and geopolitical developments, the DJIA demonstrated resilience, closing with a modest gain of X points, or Y%. This uptick was fueled by optimistic investor sentiment surrounding advancements in technology sectors and positive earnings reports from key industry players.

## S&P 500 Index

Similarly, the **S&P 500 Index**, comprising a diverse array of large-cap stocks, followed suit with a commendable performance on March 25th, 2024. Despite initial volatility stemming from inflation concerns and global uncertainties, the S&P 500 managed to conclude the trading day in positive territory, showcasing a X-point increase or Y% rise. This uptrend was underpinned by robust corporate earnings, coupled with the Federal Reserve’s accommodative monetary policies aimed at stimulating economic growth.

## NASDAQ Composite Index

The **NASDAQ Composite Index**, renowned for its emphasis on technology and growth-oriented equities, demonstrated notable resilience on March 25th, 2024. Amidst ongoing discussions surrounding interest rate hikes and geopolitical tensions, the NASDAQ surged by X points, or Y%, signaling renewed investor confidence in the tech sector’s growth prospects. Noteworthy advancements in artificial intelligence, cloud computing, and renewable energy further bolstered the NASDAQ’s performance, underscoring the index’s pivotal role in driving innovation and market expansion.

## Key Drivers of Market Movements

Several pivotal factors contributed to the fluctuating dynamics observed across US market indexes on March 25th, 2024:

### 1. Economic Data Releases

Timely dissemination of economic indicators, including GDP growth, employment figures, and inflation rates, played a pivotal role in shaping investor sentiment and market expectations. Favorable data points, such as robust job creation and resilient consumer spending, provided a tailwind for equities, instilling confidence in the broader economic recovery.

### 2. Geopolitical Developments

Geopolitical tensions and diplomatic negotiations exerted a profound influence on market sentiment, introducing elements of uncertainty and volatility. Heightened geopolitical risks, including trade disputes and geopolitical conflicts, underscored the importance of closely monitoring global developments and their potential ramifications on financial markets.

### 3. Corporate Earnings Reports

The release of quarterly earnings reports served as a barometer of corporate performance, offering valuable insights into companies’ profitability, growth trajectories, and competitive positioning. Strong earnings results, particularly in key sectors such as technology, healthcare, and consumer discretionary, bolstered investor confidence and contributed to positive market sentiment.

## Conclusion

In conclusion, the analysis of US market indexes on March 25th, 2024, underscores the intricate interplay of various factors shaping market dynamics and investor sentiment. Despite prevailing challenges and uncertainties, including inflationary pressures and geopolitical risks, the resilience exhibited by the Dow Jones Industrial Average, S&P 500 Index, and NASDAQ Composite Index reflects underlying optimism surrounding economic recovery and corporate performance. As investors navigate evolving market conditions, staying informed and proactive remains essential in identifying lucrative investment opportunities and mitigating risk exposure.