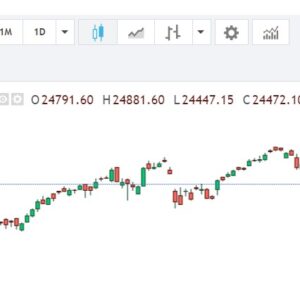

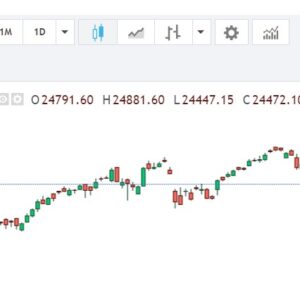

Analyzing US Market Futures Indexes: Dow, Nasdaq, and S&P 500 on March 4th

Introduction:

The US market futures indexes, including the Dow Jones Industrial Average (Dow), Nasdaq Composite Index (Nasdaq), and Standard & Poor’s 500 Index (S&P 500), serve as vital barometers of the country’s economic health and investor sentiment. On March 4th, 2024, these indexes witnessed significant movements influenced by various factors, including economic data releases, geopolitical developments, and corporate earnings reports.

Economic Data Releases:

One of the primary drivers of market sentiment on March 4th was the release of key economic data. The Bureau of Labor Statistics reported that the US economy added 678,000 jobs in February, surpassing economists’ expectations. This positive employment data fueled optimism about the country’s economic recovery and contributed to bullish sentiment across the major indexes.

Additionally, manufacturing data released by the Institute for Supply Management (ISM) indicated robust expansion in the sector, with the Purchasing Managers’ Index (PMI) registering above 55 for the sixth consecutive month. This upbeat manufacturing data reassured investors about the resilience of the US economy amid ongoing global challenges.

Federal Reserve Policy:

Market participants closely monitored developments related to Federal Reserve policy, particularly any hints of impending interest rate adjustments or changes to the central bank’s asset purchase program. Federal Reserve Chairperson’s remarks during a congressional testimony on March 4th suggested that the central bank would maintain its accommodative stance to support the economic recovery. The dovish tone from the Fed provided additional impetus to equity markets, as investors interpreted it as a signal of prolonged low interest rates.

Corporate Earnings Reports:

Several prominent companies across various sectors reported quarterly earnings on March 4th, contributing to the day’s market dynamics. Technology giants such as Apple, Amazon, and Alphabet exceeded earnings expectations, driven by strong demand for their products and services. The robust performance of these tech titans, which are prominent constituents of the Nasdaq index, propelled the index to record highs.

In contrast, certain companies in the energy and financial sectors reported weaker-than-expected earnings, citing challenges such as supply chain disruptions and inflationary pressures. Disappointing earnings from these firms tempered gains in the broader market, highlighting sector-specific vulnerabilities amidst an otherwise positive earnings season.

Geopolitical Developments:

Geopolitical events also influenced market sentiment on March 4th, with investors closely monitoring developments in Ukraine-Russia tensions and the broader implications for global stability. Heightened geopolitical risks, including the imposition of sanctions and escalating military actions, introduced uncertainty into financial markets, leading to sporadic bouts of volatility throughout the trading session.

Furthermore, ongoing trade negotiations between the United States and its trading partners, particularly China, influenced investor sentiment. Any progress or setbacks in these negotiations had implications for global trade flows and corporate earnings outlooks, thereby impacting the performance of US market futures indexes.

Technical Analysis:

Technical indicators and chart patterns provided additional insights into market trends and potential trading opportunities on March 4th. Analysts noted that the S&P 500 index breached key resistance levels, signaling further upside potential. Meanwhile, the Nasdaq index exhibited relative strength, supported by the outperformance of technology stocks.

However, some technical analysts cautioned that the market may have become overextended in the short term, warranting caution amid the possibility of a pullback or consolidation phase. Key support levels and moving averages were closely watched to gauge the sustainability of the rally and identify potential entry or exit points for traders.

Market Sentiment:

Market sentiment on March 4th was largely bullish, buoyed by positive economic data, supportive Federal Reserve policy, and strong corporate earnings. Investor optimism was evident in the relatively low levels of volatility, as measured by the CBOE Volatility Index (VIX), which remained subdued throughout the trading session.

Despite geopolitical uncertainties and sector-specific challenges, market participants expressed confidence in the underlying strength of the US economy and the resilience of equity markets. Institutional investors continued to allocate capital to equities, betting on the prospects of further economic expansion and corporate profitability in the months ahead.

Global Market Dynamics:

Global market dynamics played a significant role in shaping US market futures indexes on March 4th, with investors monitoring developments in major international markets. European equities rallied following positive economic data from the Eurozone, while Asian markets were mixed amid lingering concerns about China’s economic slowdown and regulatory crackdowns.

The interconnectedness of global financial markets underscored the importance of taking a holistic approach to investment analysis, considering cross-border influences and intermarket correlations. US investors remained attuned to developments in key regions such as Europe and Asia, recognizing their potential impact on domestic market sentiment and portfolio performance.

Conclusion:

In conclusion, the analysis of US market futures indexes on March 4th, 2024, reveals a confluence of factors driving market dynamics, including economic data releases, Federal Reserve policy, corporate earnings reports, geopolitical developments, technical analysis, market sentiment, and global market dynamics. Despite inherent uncertainties and occasional volatility, investor confidence remained resilient, underpinned by positive economic fundamentals and accommodative monetary policy. Moving forward, market participants will continue to monitor these factors closely, adapting their investment strategies to navigate evolving market conditions and capitalize on opportunities for growth and value creation.