**Analyzing Asian Stock Markets on March 14, 2024**

**Introduction**

The Asian stock markets play a pivotal role in the global economy, serving as key indicators of regional economic performance and investor sentiment. On March 14, 2024, these markets experienced notable movements, prompting a detailed analysis of the day’s events and their implications. Let’s delve into the performance of major Asian stock exchanges and the factors driving their movements.

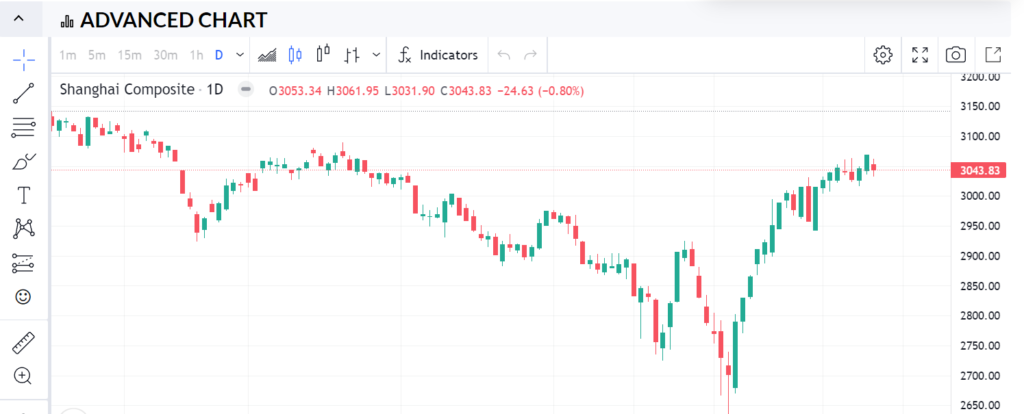

**Shanghai Stock Exchange (SSE)**

As one of the largest stock exchanges in the world by market capitalization, the Shanghai Stock Exchange (SSE) is a crucial component of the Asian financial landscape. On March 14, 2024, the SSE witnessed a mixed performance, with the benchmark Shanghai Composite Index fluctuating within a narrow range. Investor sentiment was influenced by a variety of factors, including domestic economic data releases, government policies, and geopolitical developments.

**Tokyo Stock Exchange (TSE)**

The Tokyo Stock Exchange (TSE) is the largest stock exchange in Japan and one of the most prominent in Asia. On March 14, 2024, the TSE experienced moderate gains, supported by positive economic indicators and corporate earnings reports. Japanese equities benefited from robust consumer spending, strong export data, and government stimulus measures aimed at stimulating economic growth.

**Hong Kong Stock Exchange (HKEX)**

The Hong Kong Stock Exchange (HKEX) serves as a gateway to China’s vast economy and is renowned for its dynamic trading environment. On March 14, 2024, the HKEX demonstrated resilience amidst market volatility, with the Hang Seng Index posting modest gains. Bullish sentiment towards Chinese tech stocks and optimism regarding US-China trade relations contributed to the index’s positive performance.

**Factors Influencing Market Movements**

Several factors influenced the performance of Asian stock markets on March 14, 2024. Economic indicators, such as GDP growth, inflation rates, and industrial production data, provided insights into the health of regional economies and shaped investor sentiment. Geopolitical tensions, trade negotiations, and central bank policies also played a significant role in driving market volatility and uncertainty.

Corporate earnings reports were another key driver of market movements, as investors assessed the financial performance and growth prospects of companies listed on Asian stock exchanges. Companies exceeding earnings expectations often experienced share price rallies, while disappointing earnings results could lead to declines in stock prices.

**Technical Analysis**

Technical analysis played a crucial role in guiding investment decisions on March 14, 2024, as traders utilized chart patterns, trendlines, and key support and resistance levels to identify potential entry and exit points. Technical indicators, such as moving averages, relative strength index (RSI), and stochastic oscillators, provided valuable insights into market trends and momentum.

**Conclusion**

In conclusion, the analysis of Asian stock markets on March 14, 2024, underscores the dynamic nature of regional financial markets and the myriad factors influencing their performance. Despite facing challenges and uncertainties, Asian stock exchanges exhibited resilience and adaptability, driven by positive economic indicators, corporate earnings, and investor sentiment. As investors navigate the complexities of the Asian markets, staying informed and agile remains essential in capitalizing on opportunities and mitigating risks.

**