Analyzing Asian Market Indexes on April 18th, 2024

Introduction

In this comprehensive analysis, we delve into the performance of key Asian market indexes as of April 18th, 2024. Our aim is to provide investors, analysts, and enthusiasts with valuable insights into the current state of the Asian financial markets, shedding light on trends, opportunities, and potential risks.

Overview of Asian Market Indexes

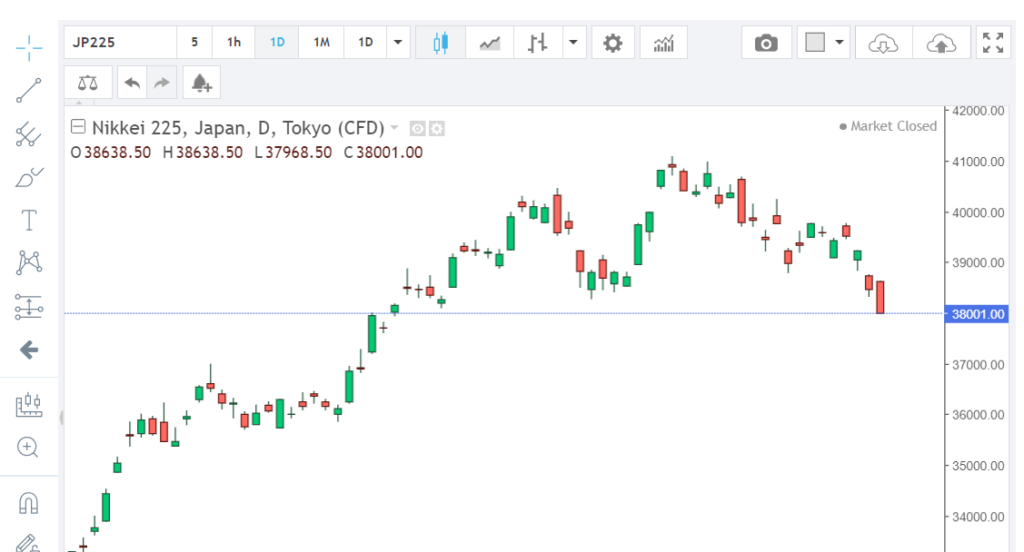

Nikkei 225

The Nikkei 225, Japan’s premier stock market index, witnessed a positive trajectory on April 18th, 2024. Buoyed by robust performances in the technology and manufacturing sectors, the index experienced steady gains throughout the trading day. Investor sentiment remained optimistic, fueled by favorable economic data and corporate earnings reports.

Shanghai Composite

Moving to China, the Shanghai Composite index displayed a mixed picture on April 18th, 2024. Despite initial volatility, the index managed to close the day with modest gains, supported by strength in the consumer and healthcare sectors. However, concerns lingered regarding regulatory reforms and geopolitical tensions, which could impact future market sentiment.

Hang Seng Index

Hong Kong’s Hang Seng Index exhibited resilience amidst global uncertainties on April 18th, 2024. Supported by strong performances in the financial and real estate sectors, the index demonstrated stability despite external challenges. Investors closely monitored developments in trade policies and geopolitical dynamics, which could influence future market movements.

Sensex

Turning to India, the Sensex index showcased robust growth on April 18th, 2024. Fueled by optimism surrounding economic reforms and corporate earnings, the index surged to new highs, attracting both domestic and international investors. Positive sentiment prevailed, with expectations of continued momentum in the Indian equities market.

Key Factors Driving Market Performance

Economic Indicators

Key economic indicators such as GDP growth, inflation rates, and unemployment figures play a crucial role in shaping market sentiment and investment decisions. Analysts closely monitor these metrics to assess the overall health of Asian economies and anticipate potential market trends.

Geopolitical Developments

Geopolitical tensions, trade disputes, and diplomatic negotiations can exert significant influence on Asian markets. Events such as regional conflicts, trade agreements, and policy changes can trigger market volatility and impact investor confidence, highlighting the interconnectedness of global geopolitical dynamics and financial markets.

Technological Advancements

The rapid pace of technological innovation continues to drive market disruptions and opportunities across Asia. Advancements in artificial intelligence, blockchain technology, and digitalization are reshaping industries and creating new investment avenues. Investors keenly track tech-related developments to capitalize on emerging trends and disruptive innovations.

Monetary Policy

Central bank policies, including interest rate decisions and monetary stimulus measures, play a crucial role in influencing market dynamics. Changes in monetary policy can affect borrowing costs, currency valuations, and liquidity conditions, impacting investor sentiment and asset valuations across Asian markets.

Conclusion

In conclusion, analyzing Asian market indexes on April 18th, 2024, provides valuable insights into the region’s economic landscape and investment opportunities. While certain indexes experienced fluctuations, others demonstrated resilience amidst prevailing uncertainties. By closely monitoring key factors such as economic indicators, geopolitical developments, technological advancements, and monetary policy, investors can make informed decisions to navigate dynamic market conditions effectively.