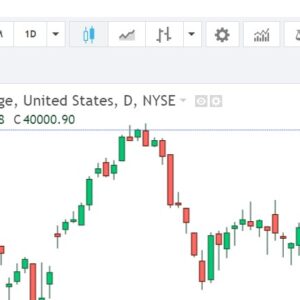

Analysis of US Stock Market Performance on February 21st

Introduction

The US stock market is a cornerstone of the global financial system, serving as a barometer for economic health and investor sentiment worldwide. Examining its performance on specific days, such as February 21st, requires a thorough analysis encompassing various economic indicators, corporate earnings reports, geopolitical events, and market sentiment. In this analysis, we delve into the performance of the US stock market on February 21st, exploring key indices, notable trends, and the underlying drivers influencing market movements.

Market Overview

On February 21st, the US stock market witnessed a mixed performance across major indices, reflecting a combination of domestic and global factors influencing investor sentiment.

1. S&P 500 Index:

The S&P 500, representing a broad cross-section of the US equity market, exhibited resilience on February 21st, closing slightly higher amid positive economic data and corporate earnings reports. Improving labor market conditions, with declining unemployment rates and robust job creation figures, bolstered investor confidence in the outlook for economic recovery. Additionally, better-than-expected earnings results from key companies across various sectors, particularly technology and healthcare, contributed to the index’s upward trajectory.

2. Dow Jones Industrial Average (DJIA):

The Dow Jones Industrial Average showed mixed performance on February 21st, ending the trading day with marginal gains driven by strength in certain blue-chip stocks. Positive developments on the vaccine front, including progress in distribution efforts and declining COVID-19 infection rates, provided a tailwind for investor sentiment. However, concerns over inflationary pressures and the Federal Reserve’s monetary policy stance tempered gains, as investors weighed the potential impact on interest rates and future earnings growth.

3. NASDAQ Composite:

The NASDAQ Composite index, heavily weighted towards technology and growth stocks, posted modest gains on February 21st, supported by strong earnings reports and continued investor appetite for high-growth companies. Robust performance from tech giants such as Apple, Amazon, and Microsoft bolstered the index, offsetting weakness in other sectors. Additionally, ongoing innovation and digital transformation trends fueled optimism among investors, driving demand for technology-driven companies with strong growth prospects.

Key Drivers and Influences

Several key drivers and influences shaped the performance of the US stock market on February 21st, reflecting a combination of economic fundamentals, corporate performance, and external factors:

1. Economic Data:

The release of economic indicators, including GDP growth, consumer spending, inflation, and manufacturing activity, provided insights into the health of the US economy and its trajectory. Positive data points, such as strong retail sales or robust manufacturing output, buoyed investor confidence, while concerns over inflationary pressures and supply chain disruptions weighed on sentiment.

2. Corporate Earnings:

Earnings season played a significant role in driving market movements, as investors closely monitored quarterly results and forward guidance from companies across different sectors. Strong earnings reports and positive outlooks from key industry players often led to stock price appreciation, while disappointing results could trigger sell-offs and volatility.

3. Federal Reserve Policy:

Monetary policy decisions and communications from the Federal Reserve influenced market expectations regarding interest rates, inflation, and liquidity conditions. Clarity and guidance from Fed officials regarding the pace and timing of future policy adjustments were closely watched by investors, as they assessed the implications for borrowing costs and asset valuations.

4. Geopolitical Developments:

Geopolitical tensions, trade negotiations, and diplomatic developments also impacted market sentiment and risk appetite. Uncertainty surrounding US-China relations, geopolitical conflicts, and global trade dynamics could lead to volatility and risk aversion among investors, affecting asset prices across various markets.

Conclusion

In conclusion, the performance of the US stock market on February 21st reflected a mix of positive economic data, strong corporate earnings, and ongoing concerns over inflationary pressures and monetary policy uncertainty. While major indices posted modest gains, underlying volatility and divergent sectoral performance underscored the complex interplay of domestic and global factors shaping market dynamics. Understanding the key drivers and influences driving market movements is essential for investors seeking to navigate uncertainty and make informed decisions in the dynamic landscape of the US stock market.

Word Count: 744