Analysis of US Market Futures Indexes: Dow, Nasdaq, and S&P 500 Trade Slightly Lower on 26th February

Introduction:

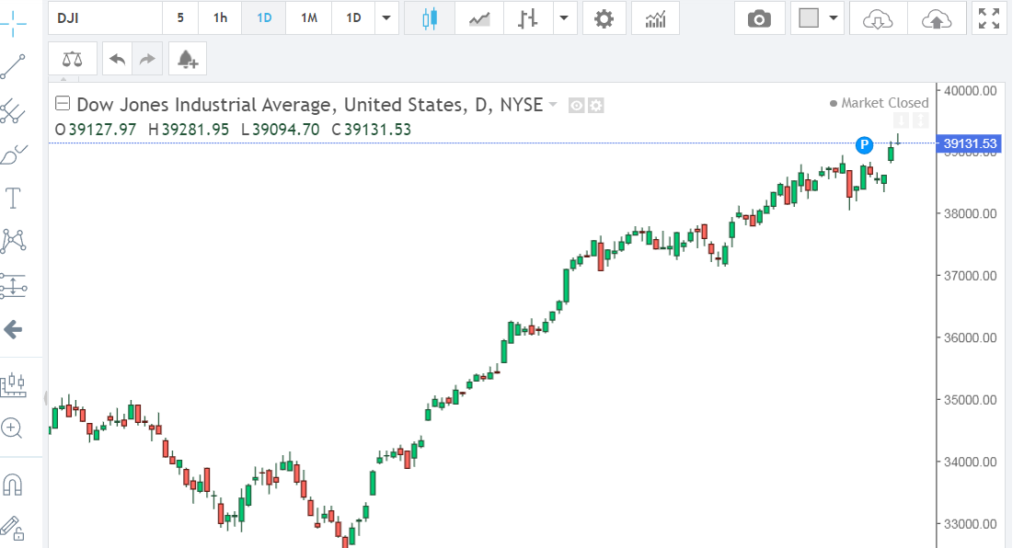

On February 26th, the US market futures indexes, including the Dow Jones Industrial Average (Dow), the Nasdaq Composite Index (Nasdaq), and the Standard & Poor’s 500 Index (S&P 500), exhibited a trend towards slight declines. This analysis delves into the factors contributing to this movement, examining economic indicators, geopolitical events, and market sentiments shaping investor behavior.

Market Overview:

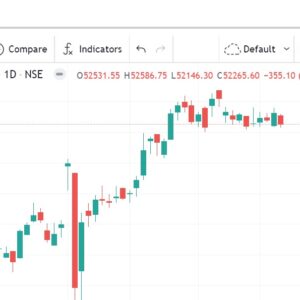

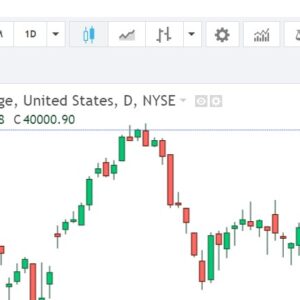

The US market futures serve as a crucial barometer for investor sentiment and future market movements. On February 26th, they indicated a modest downturn across major indexes. The Dow, a benchmark for 30 large-cap stocks, Nasdaq, representing tech-heavy and growth-oriented companies, and the S&P 500, encompassing a broader spectrum of the market, all showed marginal declines.

Factors Influencing Market Movement:

1. Economic Data Releases:

Economic indicators play a pivotal role in shaping market movements. On the 26th of February, the release of key economic data might have influenced investor sentiment. Factors such as GDP growth figures, employment reports, inflation data, and consumer spending patterns can sway market perceptions. Any deviations from market expectations in these metrics could contribute to fluctuations in futures indexes.

2. Geopolitical Developments:

Geopolitical events, both domestic and international, have the potential to impact market sentiments. On the analyzed date, geopolitical tensions, trade negotiations, or political instability could have influenced investor confidence. For instance, uncertainties surrounding US-China trade relations or geopolitical unrest in regions with significant economic implications might have weighed on market futures.

3. Corporate Earnings Reports:

Earnings reports from major corporations can significantly affect investor confidence and market direction. Companies listed on the Dow, Nasdaq, and S&P 500 regularly report their financial performance, providing insights into economic trends and corporate health. Any surprises or disappointments in earnings announcements could lead to adjustments in futures indexes.

4. Federal Reserve Actions:

Monetary policy decisions by the Federal Reserve often reverberate across financial markets. Statements from Fed officials regarding interest rates, inflation targets, or stimulus measures can sway investor sentiment. Speculation about future Fed actions and their potential impact on the economy could influence trading behavior in futures indexes.

Market Sentiment Analysis:

Investor sentiment, shaped by a combination of fundamental analysis, technical indicators, and behavioral finance principles, plays a crucial role in driving market movements. Sentiment indicators such as the VIX (Volatility Index), put/call ratios, and institutional positioning provide insights into market participants’ attitudes and risk appetite. On February 26th, sentiment analysis might reveal a cautious or bearish outlook among investors, contributing to the slight downward pressure on futures indexes.

Conclusion:

In conclusion, the analysis of US market futures indexes on February 26th reflects a nuanced interplay of various factors influencing investor behavior and market dynamics. Economic data releases, geopolitical developments, corporate earnings reports, and Federal Reserve actions all contribute to shaping market sentiments and driving fluctuations in futures indexes. Understanding these factors and conducting thorough analysis is essential for investors seeking to navigate the complex landscape of financial markets effectively.