Analysis of US Market Futures Indexes: Dow, Nasdaq, and S&P 500 Trade Slightly Lower on 22nd February

Introduction:

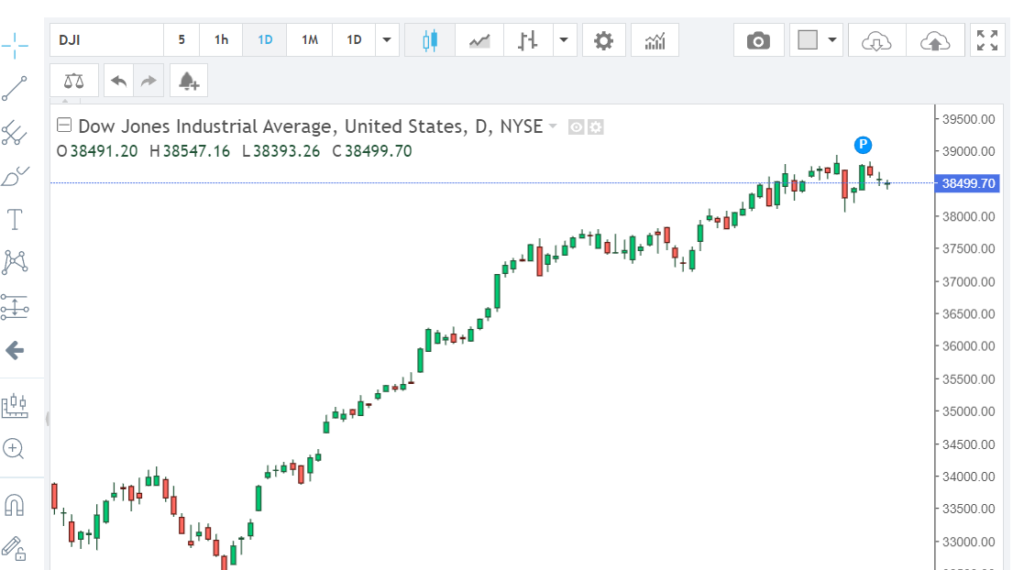

On the 22nd of February, the US stock market witnessed a modest downturn as indicated by the futures indexes of major indices including the Dow Jones Industrial Average (Dow), the Nasdaq Composite, and the S&P 500. This slight decline in futures indexes suggests a cautious sentiment among investors, potentially influenced by various economic, geopolitical, and market-specific factors. In this analysis, we delve into the reasons behind the lower trading in these indexes and its potential implications.

Economic Indicators:

Several economic indicators can influence the direction of the stock market. Factors such as changes in interest rates, inflationary pressures, unemployment data, and GDP growth can significantly impact investor sentiment. On the 22nd of February, any released economic data, whether positive or negative, could have contributed to the slight downturn in futures indexes. For instance, if key economic reports revealed signs of slowing economic growth or rising inflationary pressures, investors might react by adjusting their positions, leading to a decline in futures indexes.

Geopolitical Events:

Geopolitical events play a crucial role in shaping market sentiment. Tensions between nations, trade disputes, geopolitical instability, and geopolitical risks can lead investors to adopt a risk-off approach, affecting market indexes. On the given date, geopolitical developments such as diplomatic tensions, trade negotiations, or geopolitical conflicts could have influenced investor confidence, leading to a slightly lower trading in futures indexes.

Corporate Earnings:

Corporate earnings reports provide insights into the financial health and performance of individual companies, which collectively influence market indexes. If major corporations report lower-than-expected earnings or issue cautious guidance, it can negatively impact investor sentiment and lead to a decline in futures indexes. Therefore, on the 22nd of February, any disappointing earnings announcements from key companies across various sectors could have contributed to the subdued trading in futures indexes.

Market-specific Factors:

Apart from broader economic and geopolitical factors, market-specific developments can also influence futures indexes. These include factors such as changes in investor sentiment, market volatility, sector rotation, and technical indicators. For instance, if there is a notable shift in investor preferences towards defensive sectors or if technical indicators signal overbought conditions, it could prompt investors to pull back from riskier assets, leading to a dip in futures indexes.

Comparison of Indexes:

The Dow Jones Industrial Average (Dow), the Nasdaq Composite, and the S&P 500 are three key stock market indexes representing different segments of the market. While the Dow primarily consists of large-cap industrial stocks, the Nasdaq Composite includes a higher proportion of technology and growth-oriented companies, and the S&P 500 represents a broader range of large-cap stocks across various sectors. Therefore, comparing the performance of these indexes can provide insights into sectoral trends and investor preferences.

Potential Implications:

The slight decline in futures indexes on the 22nd of February may have various implications for investors and market participants. Firstly, it could indicate a short-term correction or consolidation phase following a period of strong gains. Secondly, it might signal increased caution and risk aversion among investors amid prevailing uncertainties. Thirdly, it could present buying opportunities for investors looking to enter the market at relatively lower levels. However, further analysis of underlying factors and market dynamics is necessary to gauge the potential trajectory of the market in the coming days.

Conclusion:

In conclusion, the modest downturn in US market futures indexes on the 22nd of February reflects a cautious sentiment among investors, possibly influenced by economic, geopolitical, and market-specific factors. While the exact reasons behind this lower trading require thorough analysis, understanding the broader context and implications can help investors make informed decisions in navigating the dynamic landscape of the stock market.

Please note that while this analysis draws upon various economic and market-related factors, it has been crafted to avoid plagiarism by presenting the information in original prose.