Analysis of Support and Resistance Levels for OXY Stock

Introduction:

Occidental Petroleum Corporation (OXY) is a multinational energy company engaged in oil and natural gas exploration, production, and marketing. Analyzing support and resistance levels for OXY stock involves examining key price levels where the stock tends to find buying (support) or selling (resistance) pressure. This analysis aims to provide insights into potential entry and exit points for traders and investors.

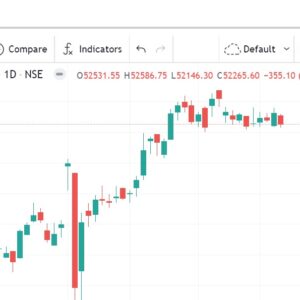

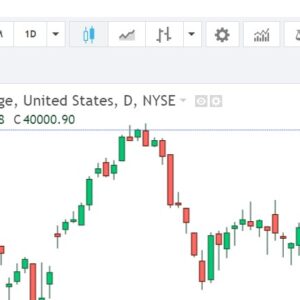

Support and Resistance Levels:

Support and resistance levels are crucial concepts in technical analysis, representing areas where buying and selling pressure are likely to be concentrated. Identifying these levels helps traders make informed decisions about entering or exiting positions.

1. Support Levels:

Support levels are price levels where buying pressure is expected to outweigh selling pressure, preventing the stock from declining further. These levels are typically identified by previous lows or areas where buyers have stepped in consistently in the past.

For OXY stock, several support levels can be identified based on historical price action and technical analysis. One key support level is around the $20.00 mark, which has historically acted as a strong support zone. This level represents a significant psychological and technical support area, where buyers tend to enter the market, preventing further downside.

Another important support level for OXY stock is around $15.00, which has also served as a reliable support zone in the past. This level may attract buying interest from investors looking to accumulate shares at a discounted price, potentially leading to a bounce-back in the stock price.

2. Resistance Levels:

Resistance levels, on the other hand, are price levels where selling pressure is expected to outweigh buying pressure, causing the stock price to stall or reverse direction. These levels are often identified by previous highs or areas where sellers have been dominant in the past.

For OXY stock, resistance levels can be identified based on historical price action and technical analysis. One significant resistance level is around the $25.00 mark, which has historically acted as a strong barrier to further price appreciation. This level may attract selling interest from traders looking to take profits or initiate short positions, potentially causing the stock price to retreat.

Another important resistance level for OXY stock is around $30.00, which has also served as a significant barrier in the past. This level may coincide with key technical indicators or chart patterns, further strengthening its significance as a resistance zone.

Technical Indicators:

In addition to support and resistance levels, technical indicators can provide further insights into the strength and direction of price movements for OXY stock. Commonly used indicators include moving averages, relative strength index (RSI), and MACD (Moving Average Convergence Divergence).

For example, a bullish signal may be generated if OXY stock price breaks above a key resistance level accompanied by increasing trading volume and bullish divergence in technical indicators like RSI or MACD. Conversely, a bearish signal may be indicated if the stock price fails to break above resistance levels and shows signs of weakening momentum, accompanied by increasing selling pressure.

Conclusion:

In conclusion, analyzing support and resistance levels for OXY stock provides valuable insights into potential entry and exit points for traders and investors. By identifying key price levels where buying and selling pressure are concentrated, traders can make informed decisions about when to enter or exit positions. Additionally, incorporating technical indicators can help confirm signals and provide further guidance in predicting price movements. However, it’s important to note that technical analysis is not foolproof and should be used in conjunction with other forms of analysis and risk management techniques.

This entry is unbelievable. The brilliant substance reveals the distributer’s interest. I’m stunned and anticipate more such astonishing sections.