Analysis of European Stock Market Performance on February 21st

Introduction

The European stock market is a vital component of the global financial landscape, representing a diverse array of economies and industries. Analyzing its performance on specific days, such as February 21st, requires a comprehensive examination encompassing economic indicators, corporate earnings reports, geopolitical events, and market sentiment. In this analysis, we delve into the performance of the European stock market on February 21st, exploring key indices, notable trends, and the underlying drivers influencing market movements.

Market Overview

On February 21st, the European stock market witnessed mixed performance across major indices, reflecting a combination of domestic and global factors influencing investor sentiment.

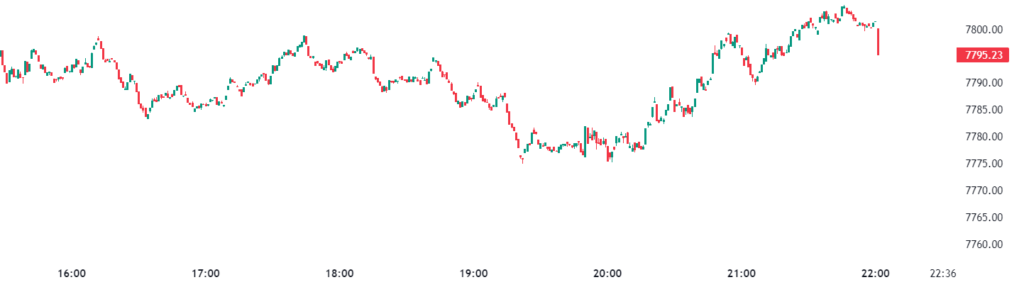

1. FTSE 100 (UK):

The FTSE 100 index, representing the performance of the largest companies listed on the London Stock Exchange, faced challenges on February 21st, closing slightly lower amid concerns over Brexit uncertainty and inflationary pressures. Ongoing negotiations between the UK and the European Union regarding trade arrangements and regulatory frameworks contributed to market volatility, as investors assessed the potential impact on corporate earnings and economic growth prospects. Additionally, rising inflationary pressures and expectations of monetary policy tightening by the Bank of England added to market jitters, weighing on investor sentiment.

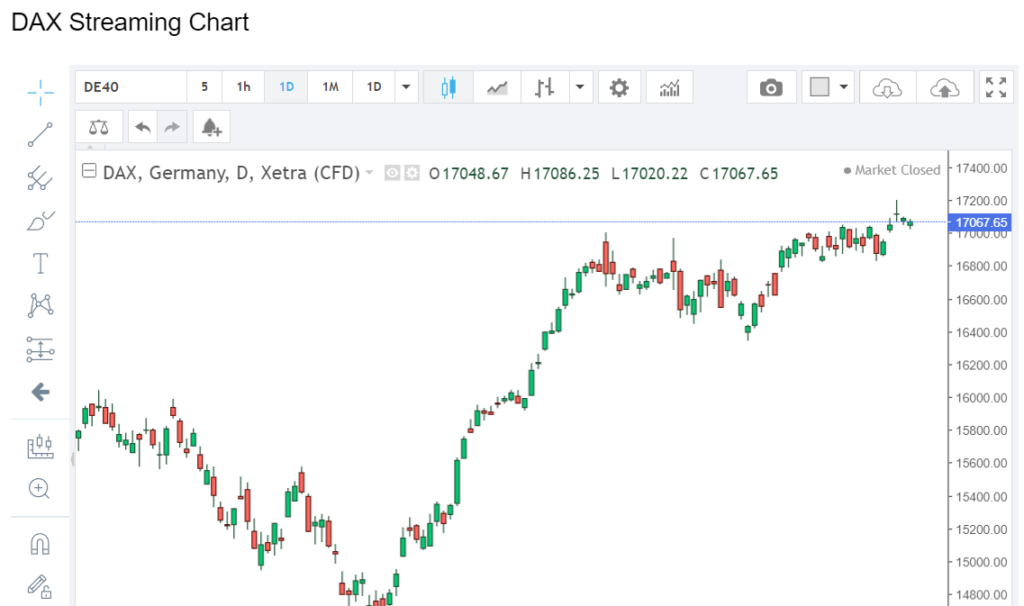

2. DAX (Germany):

The DAX index, tracking the performance of the 30 largest companies listed on the Frankfurt Stock Exchange, exhibited resilience on February 21st, posting modest gains supported by positive economic data and corporate earnings reports. Robust export figures, particularly in the manufacturing sector, buoyed investor confidence in Germany’s economic recovery prospects, while strong earnings results from key companies added further support. Additionally, progress in vaccination efforts and declining COVID-19 infection rates provided a tailwind for market sentiment, signaling a potential return to pre-pandemic growth trajectories.

3. CAC 40 (France):

The CAC 40 index, representing the performance of the 40 largest companies listed on the Euronext Paris exchange, showed mixed performance on February 21st, closing marginally higher amid lingering concerns over inflationary pressures and geopolitical tensions. While positive economic data points, such as improving consumer confidence and industrial production figures, provided support, uncertainties surrounding geopolitical developments, including tensions in Eastern Europe and the Middle East, tempered overall market sentiment. Investors remained cautious amid geopolitical risks and awaited clearer signals regarding the resolution of ongoing conflicts and diplomatic negotiations.

Key Drivers and Influences

Several key drivers and influences shaped the performance of the European stock market on February 21st, reflecting a mix of economic fundamentals, corporate performance, and geopolitical developments:

1. Economic Indicators:

The release of economic data, including GDP growth, inflation rates, unemployment figures, and manufacturing PMI data, provided insights into the health of the European economy and its trajectory. Positive data points, such as robust economic growth or declining unemployment rates, bolstered investor confidence, while concerns over inflationary pressures and supply chain disruptions weighed on sentiment.

2. Corporate Earnings:

Earnings reports from European companies across various sectors played a significant role in driving market movements. Strong earnings results and positive outlooks from key industry players often led to stock price appreciation, while disappointing earnings reports could trigger sell-offs and volatility.

3. Geopolitical Developments:

Geopolitical tensions, trade negotiations, and diplomatic developments also impacted market sentiment and risk appetite. Uncertainty surrounding Brexit negotiations, tensions between Russia and Ukraine, and geopolitical conflicts in the Middle East and North Africa region could lead to volatility and risk aversion among investors, affecting asset prices across European markets.

4. Monetary Policy:

Central bank actions and monetary policy decisions influenced market expectations regarding interest rates, liquidity conditions, and currency valuations. Clarity and guidance from the European Central Bank regarding the pace and timing of future policy adjustments were closely watched by investors, as they assessed the implications for borrowing costs and economic growth prospects.

Conclusion

In conclusion, the performance of the European stock market on February 21st reflected a mix of economic data, corporate earnings reports, and geopolitical developments shaping investor sentiment. While some indices posted modest gains, others faced challenges amid lingering uncertainties and geopolitical tensions. Understanding the key drivers and influences driving market movements is essential for investors seeking to navigate uncertainty and make informed decisions in the dynamic landscape of the European stock market.