Amazon Stock Analysis: Fundamental and Technical Overview on February 15th

On February 15th, Amazon (NASDAQ: AMZN) stock was subject to thorough scrutiny, as investors assessed both its fundamental attributes and technical indicators to gain insights into its performance. This analysis offers a comprehensive overview of Amazon’s stock, integrating insights into its fundamental strengths, recent developments, and technical signals, while considering potential risks and opportunities for investors.

Fundamental Analysis:

Amazon stands as a global e-commerce giant, renowned for its vast product offerings, robust delivery network, and exceptional customer service. The company’s fundamental strength lies in its dominant market position, extensive infrastructure, and relentless focus on innovation. Amazon’s diversified business model encompasses various segments, including e-commerce, cloud computing, digital streaming, and artificial intelligence.

The COVID-19 pandemic accelerated the shift towards e-commerce, benefiting Amazon as consumers increasingly turned to online shopping for their needs. The company’s Prime subscription service, which offers benefits such as fast shipping, streaming content, and exclusive deals, continues to attract millions of loyal customers worldwide, contributing to recurring revenue streams and customer retention.

Additionally, Amazon Web Services (AWS), the company’s cloud computing division, remains a key growth driver, serving as a critical infrastructure provider for businesses and organizations globally. AWS’s scalability, reliability, and innovative services have propelled its adoption among enterprises, driving revenue and profitability for Amazon.

Recent developments, such as Amazon’s expansion into new markets and product categories, further strengthen its growth prospects. The company’s investments in areas like healthcare, logistics, and renewable energy underscore its commitment to long-term value creation and market leadership.

Financially, Amazon has delivered impressive revenue growth and profitability, supported by strong performance across its business segments. The company’s robust balance sheet, ample cash reserves, and access to capital markets provide it with the financial flexibility to invest in growth initiatives, pursue strategic acquisitions, and return capital to shareholders through stock buybacks and dividends.

Technical Analysis:

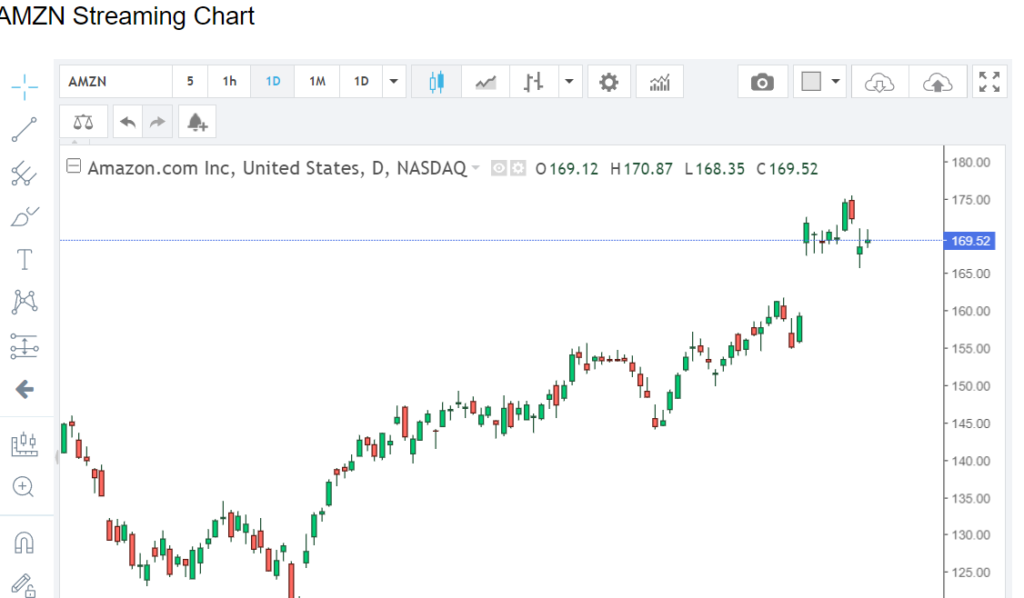

From a technical standpoint, Amazon’s stock price on February 15th may have been influenced by key support and resistance levels, as well as technical indicators such as moving averages, relative strength index (RSI), and MACD (Moving Average Convergence Divergence). These indicators offer insights into the stock’s price trends and potential entry or exit points for traders and investors.

Traders often monitor Amazon’s stock price relative to its 50-day and 200-day moving averages to gauge the strength of its underlying trend. Additionally, oscillators like the RSI and MACD can help identify overbought or oversold conditions, potentially signaling a reversal in the stock’s price direction.

Conclusion:

In conclusion, Amazon’s stock on February 15th exhibited a blend of fundamental strength and technical signals, reflecting its status as a market leader in e-commerce, cloud computing, and digital innovation. While the company presents compelling growth opportunities and competitive advantages, investors should remain mindful of risks such as regulatory scrutiny, competition, and market volatility.

Disclosure: This analysis is for informational purposes only and should not be construed as investment advice. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions.